Toastique Breakfast Franchises’ mission is to make healthy eating accessible, exciting, simple, and easy to enjoy.

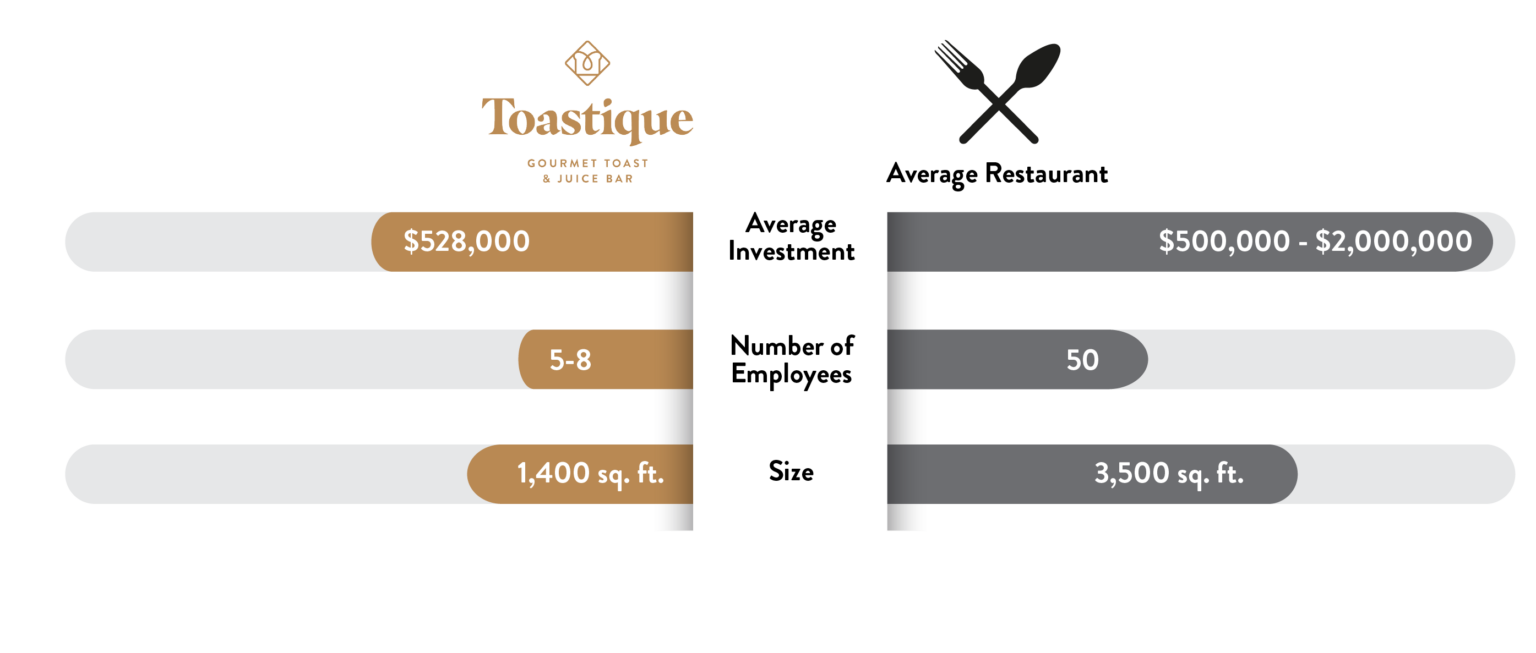

The low cost of entry into the restaurant industry is a big reason Toastique isn’t just one of the best breakfast franchises for sale — it’s one of the best restaurant franchise business opportunities available, period.

HOW MUCH CAN I MAKE?

$712,148

*

Refer to 2025 Franchise Disclosure Document Item 19-table 12

How much does a Toastique breakfast restaurant franchise cost?

$370,117

Starting Initial Investment From*

Required Liquid Capital

$55,000

*Refer to 2024 Franchise Disclosure Document Item 7- Franchise Agreement – ‘Total Estimate’

Financial Investment Breakdown

| Type of Expenditure | Low Amount | High Amount |

|---|---|---|

| Initial Franchise Fee | $55,000 | $55,000 |

| Go to Market Launch Fee | $8,000 | $8,000 |

| Construction and Leasehold Improvements | $122,617 | $489,342 |

| Lease Deposit – 3 Months | $6,000 | $15,000 |

| Furniture, Fixtures and Equipment | $60,000 | $110,000 |

| Store Art & Feature Wall | $5,000 | $8,000 |

| Signage | $8,000 | $18,000 |

| Computer, Software and Point of Sales System | $1,000 | $1,500 |

| Grand Opening Marketing | $20,000 | $32,000 |

| Initial Inventory | $30,000 | $32,000 |

| Utility Deposits | $250 | $1,500 |

| Insurance Deposits – 3 Months | $250 | $1,000 |

| Travel for Initial Training | $3,000 | $8,000 |

| Professional Fees | $10,000 | $36,000 |

| Licenses and Permits | $1,000 | $3,000 |

| Additional Funds – 3 Months | $40,000 | $40,000 |

| Total Estimate | $370,117 | $846,342 |

Invest in Your Dream Franchise…

for a Healthy Price!

for a Healthy Price!

If the cost of investing in a restaurant is holding you back from your dream of owning a health-focused café, it’s time to take a look at Toastique Gourmet Toast & Juice Bar.

Our simple, healthy franchise model and small footprint eliminates the need for most of the complex equipment that can drive up the price tag on your total financial investment, leaving you with a breakfast restaurant that’s as easy to operate as it is to afford!

See why Toastique is one of the best health food franchise opportunities in the industry.

©Toastique 2024 | Privacy Policy | Terms & Conditions | Sitemap | News

This information is not intended as an offer to sell, or the solicitation of an offer to buy, a franchise. It is for information purposes only. An offer is made only by a Franchise Disclosure Document (FDD) in those jurisdictions that require it. Currently, the following states regulate the offer and sale of franchises: California, Hawaii, Illinois, Indiana, Maryland, Michigan, Minnesota, New York, North Dakota, Oregon, Rhode Island, South Dakota, Virginia, Washington, and Wisconsin. If you are a resident of or want to locate a franchise in one of these states, we will not offer you a franchise unless and until we have complied with applicable pre-sale registration and disclosure requirements in your jurisdiction. The information contained in this website is not inconsistent with our FDD. This advertisement is not an offering. An offering can only be made by a prospectus filed first with the appropriate state regulatory agencies. Such filing does not constitute approval by those states.